How can Accounts Receivable automation help your enterprise?

![]() Receiving and posting payments can be easier than ever with automated AR solutions from PaperFree! Our leading Accounts Receivable processing solutions enable you to scan, classify, and index paper documents as well as capture electronic invoices, all while saving you time and increasing accuracy. Our queue-based workflow and automatic notifications make management easy while integrating with enterprise resource planning (ERP) and line of business (LOB) systems. Our systems also account for archiving and compliance needs - your data will be safe, accessible, and in compliance.

Receiving and posting payments can be easier than ever with automated AR solutions from PaperFree! Our leading Accounts Receivable processing solutions enable you to scan, classify, and index paper documents as well as capture electronic invoices, all while saving you time and increasing accuracy. Our queue-based workflow and automatic notifications make management easy while integrating with enterprise resource planning (ERP) and line of business (LOB) systems. Our systems also account for archiving and compliance needs - your data will be safe, accessible, and in compliance.

In addition, PaperFree offers DepositCritical, an advanced check processing solution that enables your enterprise to process payments inline with other documents. And, Check21 processing clears checks in house so you can eliminate expensive lockbox services and losing access to your documents while they are processed. Visit DepositCritical Check Processing to learn more.

In addition, PaperFree offers DepositCritical, an advanced check processing solution that enables your enterprise to process payments inline with other documents. And, Check21 processing clears checks in house so you can eliminate expensive lockbox services and losing access to your documents while they are processed. Visit DepositCritical Check Processing to learn more.

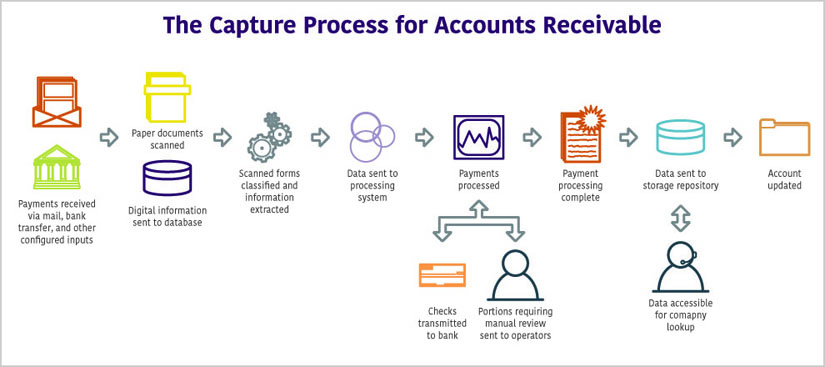

How does it work?

- The first step in our accounts receivable processing is to gather payments to process. Typically, these payments arrive in paper form by mail.

- Next, any invoice data is introduced into the system by scanning paper documents or importing electronic files into a processing queue.

- Once documents are scanned and ready in the queue, they are analyzed and business-critical information such as names, account numbers, and dollar amounts are extracted and digitized.

- This digital information is then sent to a custom workflow where it is processed and sent to operators as needed. All of this happens automatically, and once manual steps (such as a management approval) are completed the document continues on to its next step with no additional action required on the operator's part.

- Once processing is complete and a payment posted, the scanned invoice image as well as the information about its transaction are exported to a storage repository. Here, it can be stored for compliance or can be easily pulled up by operators for customer service, management, or training needs.

Key Benefits

- End-to-end management – Integrate all key processes, from receipt and approval to archiving and auditing—and provide complete visibility into the entire process.

- Control and compliance – Retain and archive documents in compliance with government and company policies.

- Streamlined work – Provide users with a streamlined user interface that offers seamless integration between data from ERP or LOB systems and full views of all supporting documentation.

- Vendor responsiveness – Quickly retrieve up-to-date, accurate vendor information, and respond promptly to vendor inquiries.

- Elimination of paper storage – Eliminate the need for physical paper storage—digitize all documents and take advantage of records retention and storage capabilities.

Let PaperFree evaluate your enterprise's Accounts Receivable needs and learn just how quickly you can be fully automated and processing payables faster and easier than ever before.