![]() Debt Collection services are a necessary tool of any financial institution - their specialized services to recover owed funds reduce the burden of losses that can easily add up to overwhelming amounts. However, the paperwork involved in running a debt collection service can become overwhelming as well - case information, correspondence, legal filings, and other important information must be carefully stored and adhere to government regulations. Mismanagement of files can easily lead to severe repercussions - up to and including fines, lawsuits, and having to dismiss cases. PaperFree offers solutions and support to streamline your debt collection enterprise's information management process and receiving settlement payments.

Debt Collection services are a necessary tool of any financial institution - their specialized services to recover owed funds reduce the burden of losses that can easily add up to overwhelming amounts. However, the paperwork involved in running a debt collection service can become overwhelming as well - case information, correspondence, legal filings, and other important information must be carefully stored and adhere to government regulations. Mismanagement of files can easily lead to severe repercussions - up to and including fines, lawsuits, and having to dismiss cases. PaperFree offers solutions and support to streamline your debt collection enterprise's information management process and receiving settlement payments.

Key Benefits

- End-to-end management – Integrate all key processes, from receipt and approval to archiving and auditing—and provide complete visibility into the entire process.

- Control and compliance – Meet and retain compliance with government and company policies.

- Streamlined work – Provide users with a streamlined user interface that offers seamless integration between data and full views of all supporting documentation.

- Elimination of paper storage – Eliminate the need for costly physical document storage—digitize all documents and take advantage of records retention and and electronic storage capabilities.

How does it work?

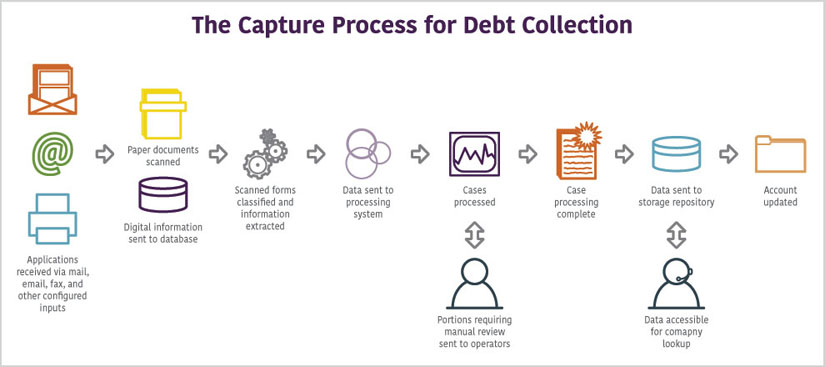

As information arrives at your organization, it needs to be digitized so that it can be property processed. PaperFree eases the process with powerful information capture solutions. With these systems, paper forms can be scanned, digitized, and the recognized data fed into a backend system for further processing. These systems remove the need for most manual data entry - saving you time, errors, and allowing you to expedite the process of creating and updating case files. Once the incoming information has been collected, it is put to work by a flexible content management solution. These solutions manage your data digitally in one central location, allowing you to connect related information, distribute it to workers, and process multi-step functions with customizable workflows. These workflows ease the burden as well - the work does not advance to the next step until all previous requirements have been completed, eliminating errors and last minute headaches. Your data is also secure: information can only be accessed by workers with permission to do so and there is no need to maintain storage of paper documents. Forget documents that go missing or having to wait days for boxes full of papers to arrive from storage - it's all at your fingertips.

PaperFree also offers solutions to assist your organization in managing the payments that arrive to settle accounts. Easily capture and process checks with flexible Check21 check processing solutions that clear payments on-site without the need for lockbox services or losing access to documents. Our solutions integrate with a variety of capture systems as well as your financial institution and work inline with the data capture process - there is no need to manually separate checks from their supporting documentation!

With PaperFree, debt collection enterprises can manage their files, track their progress, and maintain detailed reports of all correspondence. Information capture and content management systems are an essential tool for the process start to finish, and to also serve as a central repository for ongoing information relating to customers and the cases they are involved in. To find out more about how we can help your Debt Collection organization streamline and advance, give us a call today.